Business Account Analysis & Earnings Credit

Park View is always looking for ways to enhance our products and services for our members. That is why we are excited to announce that an account analysis with the opportunity for an earnings credit is now an added feature to our Select Business accounts.

Account Analysis will analyze your daily checking account balances to determine if your account is eligible for a monthly earnings credit1, which can offset all or some of your monthly fees.

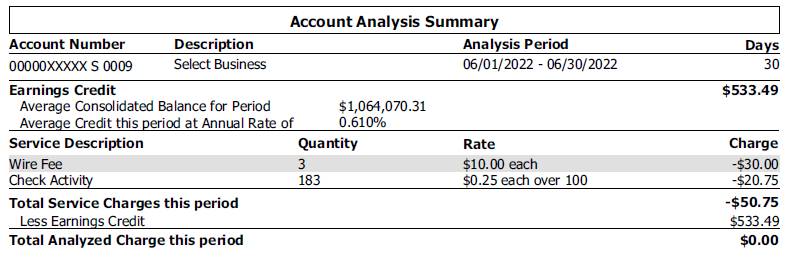

Beginning with your August statement, you will see an account analysis summary which details the fees and service charges eligible to be offset by your earnings credit. Please reference the sample statement below.

Please note that not all fees and charges are eligible to be offset by your earnings credit. The following fees will be deferred until the end of the month and are eligible to be offset. Within your online transaction description, you will see 'Fee Deferred.'

| Excess Cash/Checks | Official Checks |

| Cash/Coin Orders | Return Deposits |

| Overdraft Transfers | Wires (Foreign & Domestic) |

| Paper Statement | Safe Deposit Box |

| ACH Origination |

Fees not eligible for offset will continue to be listed under the account transaction description and will not be included in the account analysis summary.

Account Analysis FAQs

Have more questions?

If you have any questions about what impact Account Analysis and/or earnings credit will have on your account, please contact our Member Business Advisor team at mba@pvfcu.org or call 540.236.5761.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.