HOME EQUITY LINES OF CREDIT

Hybrid Home Equity Line of Credit (HELOC)

One line of credit. Two rate options.

Stability of a fixed rate & payment

Lock a portion of your balance1

Easy access to home's equity

Use equity how you choose

Home Equity Line of Credit (HELOC)

Borrow what you need, when you need it.

Variable-rate & payment, based on prime

Lower initial monthly payments

Easy access to funds

Use what you need

We Also Offer

Home Equity Loans

Hybrid Mortgages

Why choose a Park View HELOC?

No pre-payment penalties. No annual maintenance fees.

Hybrid HELOC - pay a fee every time you lock in a segment.

If you have a $25,000 credit limit and only use $10,000, you will only pay interest on the $10,000.

Some renovations may qualify as a tax-deductible expense. Consult your tax advisor.

Lock in all or a fixed portion of your balance with our Hybrid HELOC or opt for a variable rate with our regular HELOC.

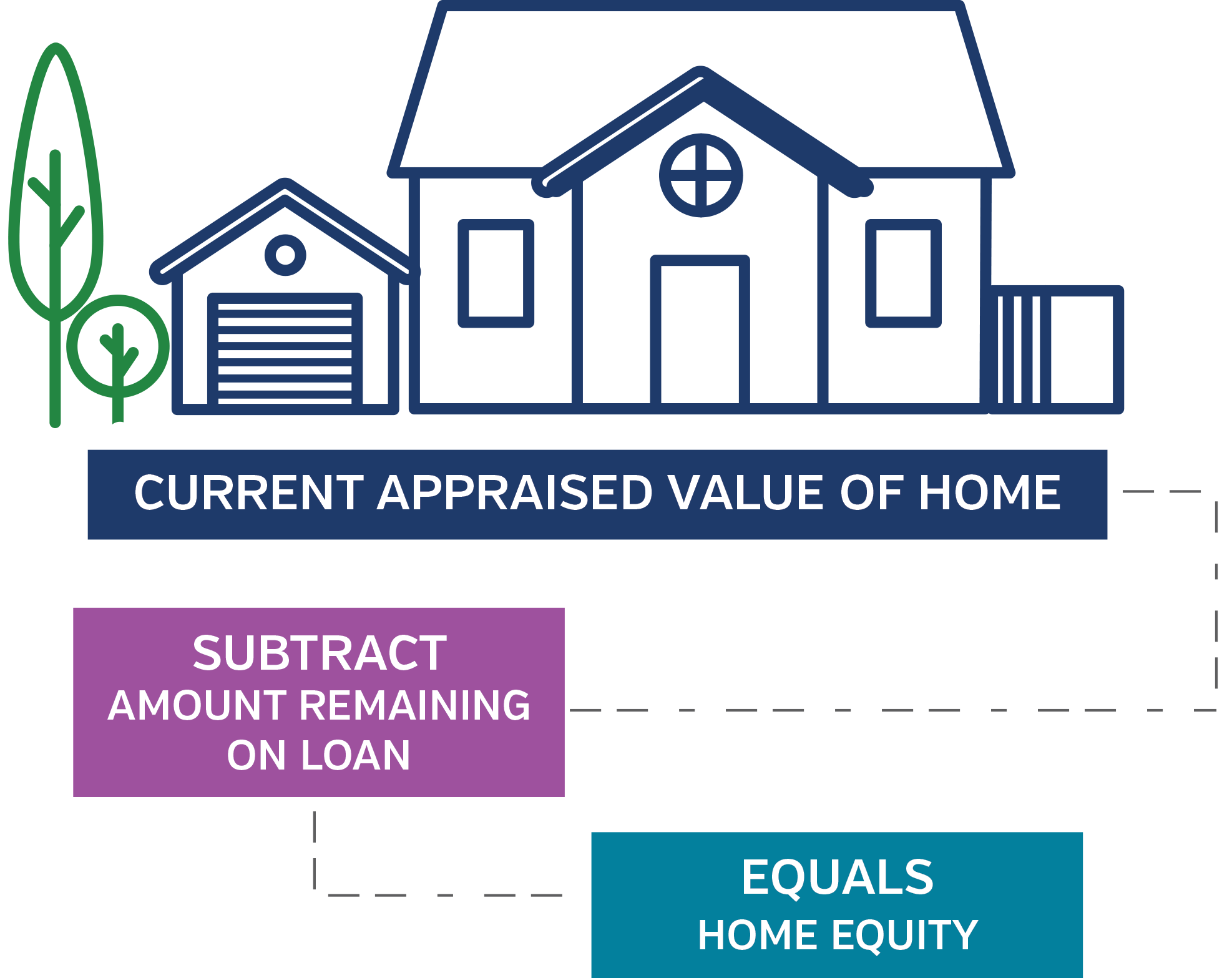

So, what is equity?

Equity is the current value of your home minus the amount you still owe on your mortgage

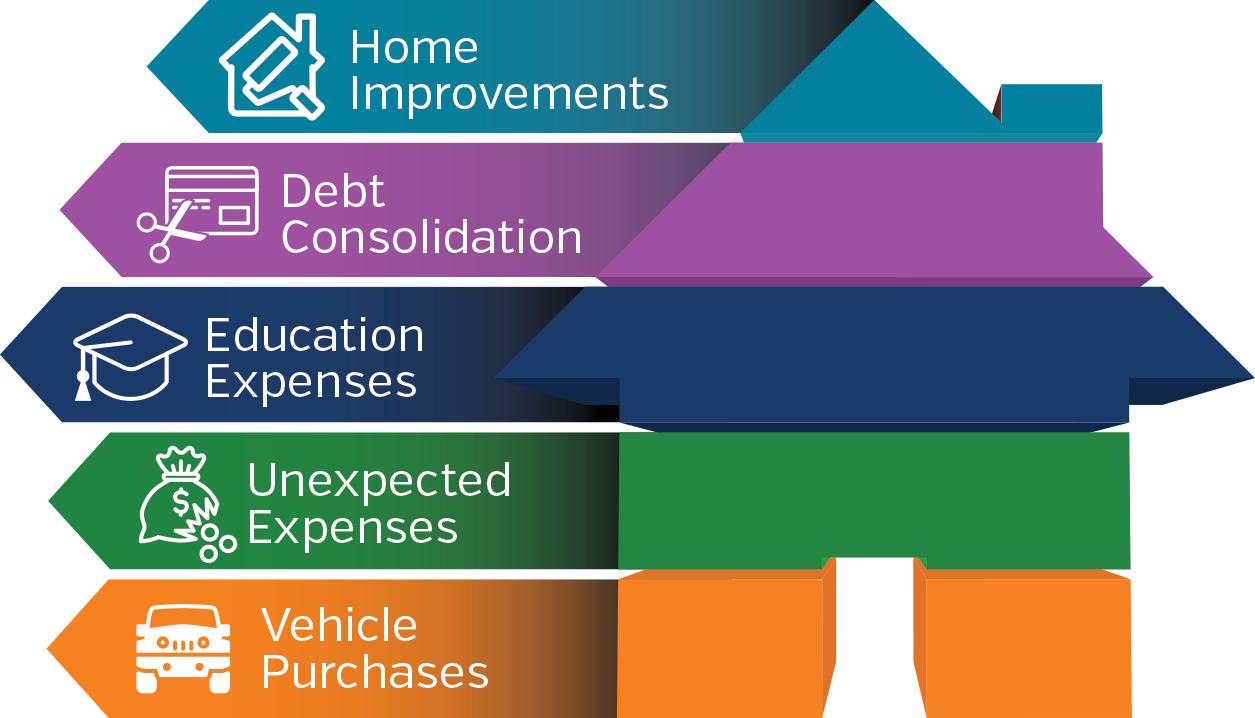

Take advantage of your home's equity

Use the equity in your home to pay for some of life's larger expenses such as home improvements, debt consolidation, education expenses, and unexpected expenses.

Floor rate on all HELOC products = 3.25% Annual Percentage Rate. A HELOC requires you to pledge your home as collateral and you could lose your home if you fail to repay. Minimum Payment Requirements: You can obtain advances of credit (the "draw period") for 60 months. During the draw period, payments will be due monthly. Your minimum monthly payment will equal the finance charges that have accrued on the balance plus credit life insurance premium (if any), plus any past due payments and amounts that exceed your credit limit. The minimum payment during the draw period will not reduce the principal that is outstanding on your line. You will be required to pay the entire outstanding balance in a single payment.

1Hybrid Home Equity Line of Credit (HELOC) allows you to create up to five (5) fixed loan segments with a minimum of $5,000 for each loan segment. Up to 50% of the HELOC limit can be a fixed-rate segment. Fixed terms will be based on the existing rate of the HELOC. The fee structure remains the same as the regular HELOC initial loan application. There is a $25 fee to set up each segment. For qualified borrowers only. Contact Park View for full details.

2Consult a tax advisor regarding the deductibility of interest.

3APR = Annual Percentage Rate. Your actual APR will be determined at the time of the application and will be based on your application, combined loan to value, and credit information. Not all applicants will qualify for the lowest rate.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.