HYBRID HOME EQUITY LINE OF CREDIT

How it Works

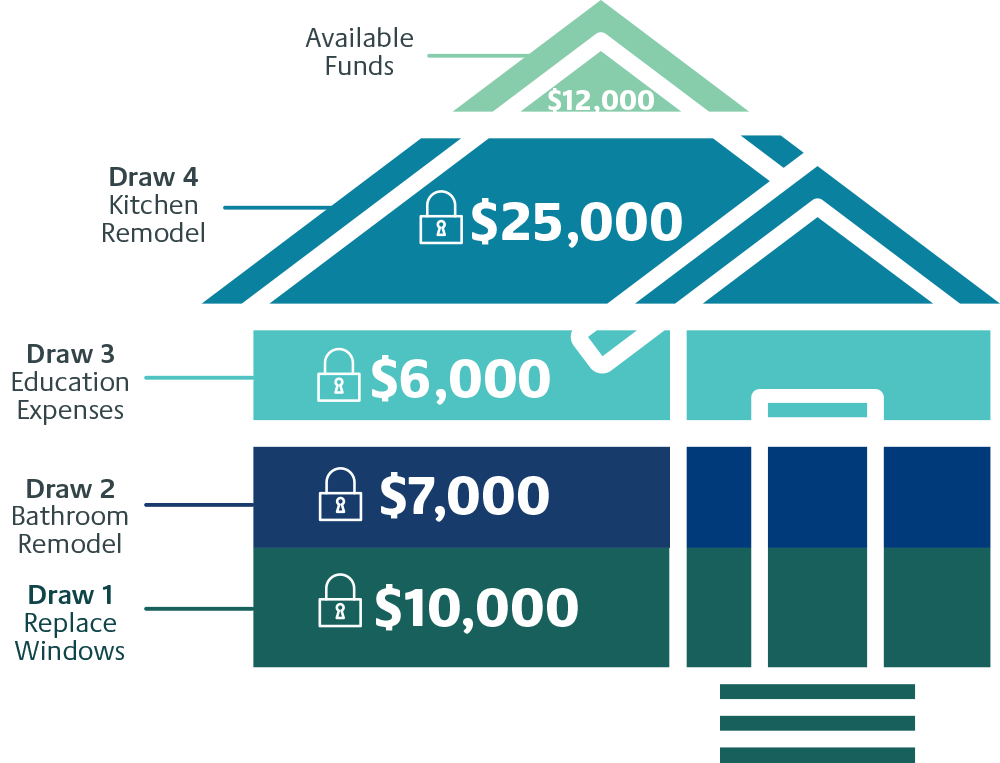

- Use your Hybrid HELOC as you need it, for anything you need

- You can lock all or a portion of your Hybrid HELOC balance into a fixed-rate segment for a specified period of time during your draw period1

- Up to 5 locks at one time

- Minimum segment lock amount is $5,000

Hybrid HELOC Benefits

- Keep payments steady by locking in a fixed-rate

- Easy access to the equity in your home

- No pre-payment penalties

- Potential tax savings2

- Use for recurring home remodeling, major purchases, tuition costs, and any other use

Hybrid HELOC Example: $60,000 Line of Credit

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.