Person-to-Person (P2P) Payments

Person-to-Person Payments

Send Money to Almost Anyone

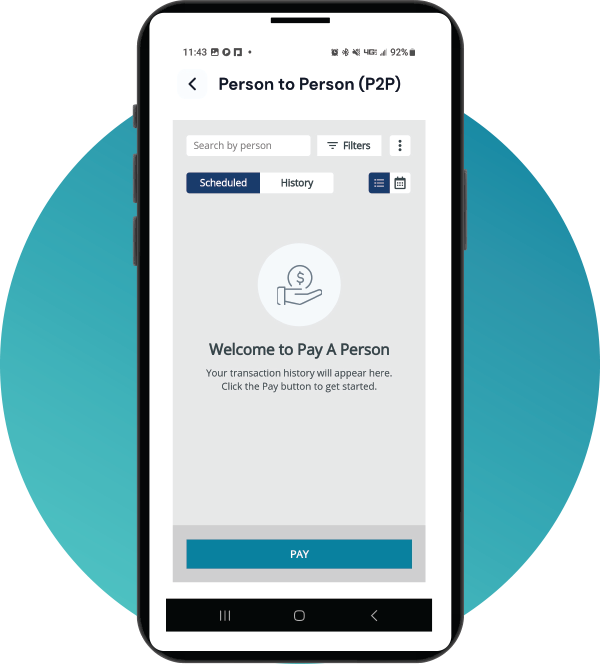

Experience the seamless convenience of digital transactions with our Person-to-Person (P2P) payment platform. Say goodbye to the hassles of cash transactions and embrace a new era of sending and receiving money as effortlessly as sending an email or a text message. P2P has got you covered for all your financial needs, whether it's repaying family and friends, paying allowances, splitting bills, or sending that perfect birthday gift.

Managing your finances and sending money has never been more straightforward. Embrace the speed, efficiency, and security of P2P payments!

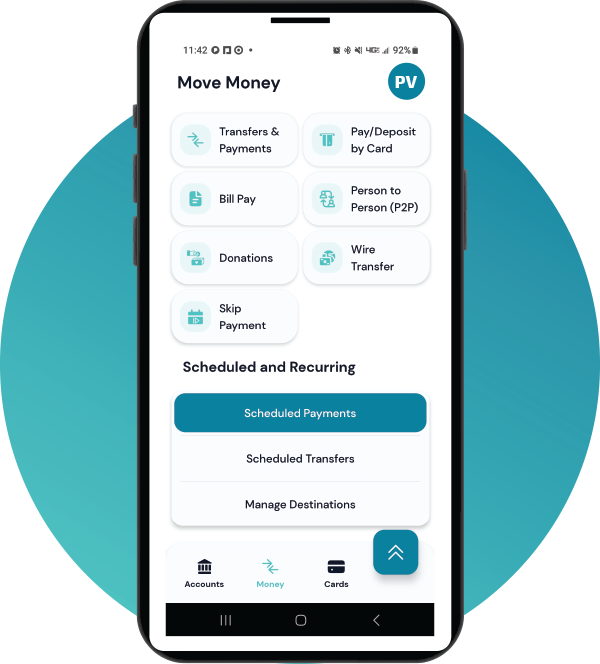

How to Get Started with Person-to-Person (P2P):

- Log in to Your Online Banking Account: Navigate to the "Move Money" section to kickstart your P2P journey.

- Select Person-to-Person (P2P): Locate and click on 'Move Money," then select "Person-to-Person."

- Choose the Default Funding Account: Set your default funding account for quick and easy transactions.

- Payment Alerts: Personalize your alert preferences. Receive notifications for successful payments, reminders, and other relevant updates.

Person-to-Person (P2P): Adding Contacts

- Manage Contacts: Add a new contact effortlessly by entering their first name, last name, mobile number, and email.

- Specify Payment Delivery: Tailor how you want the payment to be delivered to your contact, whether through mobile or email. Save the contact information for future transactions.

Person-to-Person (P2P) FAQs

For real-time deposits, there is a fee of $1.99, which is paid by the recipient.

There is no fee for ACH deposits.

The recipient will decide if they want to receive it in real time with the fee or wait a few days with no fee.

No, your payment will be made from the funding account you selected.

If the recipient chooses to collect the money "in real-time," the money will be available to them immediately. Otherwise, the transaction will be processed via the Automated Clearing House (ACH) network, and the money will be available in 1 to 3 business days, depending on their financial institution's process.

Absolutely! Your funds are sent securely using just an email address or phone number. Plus, P2P is built into our online and mobile Banking platforms, which include many security features designed to protect your financial information.

It's important to note that even though the connection is secure, you should never share your username, password, or security codes with anyone. Park View will never call you to ask for this information.

Yes, you can transfer up to $250 per day for the initial 30 days. Following this introductory period, your daily limit increases to $750.

The process for receiving funds varies depending on whether it's processed via debit or ACH and if the recipient is a first-time or recurring beneficiary. The system is designed to guide recipients through the necessary steps.

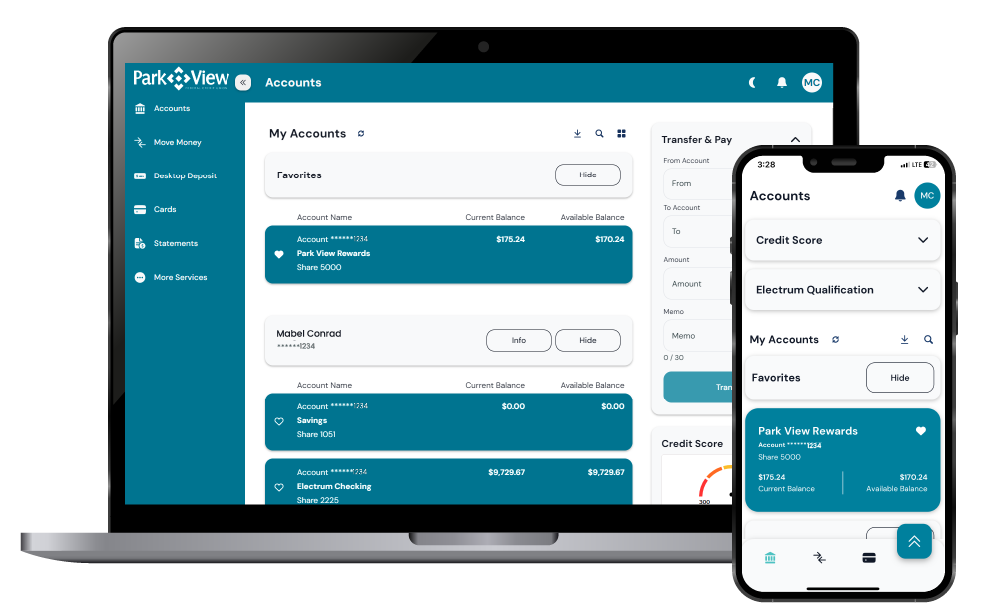

Online and Mobile Banking

Conveniently check your balances, make a transfer, pay bills, access your statements and more.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.