Defending Against Impersonation Scams

In an era where our lives are intertwined with technology more than ever before, scammers have adapted to use technology to exploit personal information. Impersonation scams, commonly referred to as spoofing, have become more sophisticated, with fraudsters targeting unsuspecting individuals and posing as trusted entities, including Park View Federal Credit Union.

To help you safeguard your personal information, we’ll dive into impersonation scams, uncovering their details, exploring examples, and equipping you with the knowledge to fortify your defenses.

What is an impersonation scam?

An impersonation scam is a deceptive tactic used by scammers to trick individuals into believing they are interacting with a trusted entity, such as a reputable company, government agency, or even a friend or family member. These scams often involve impersonating legitimate organizations through various means, such as spoofed emails, misleading text messages, or spoofed phone calls. The goal of impersonation scams is typically to obtain sensitive information, such as personal identification details, financial data, or login credentials, which can then be used for fraudulent purposes, including identity theft, financial fraud, or unauthorized access to accounts.

Spotting the Act: Red Flags to Watch Out For

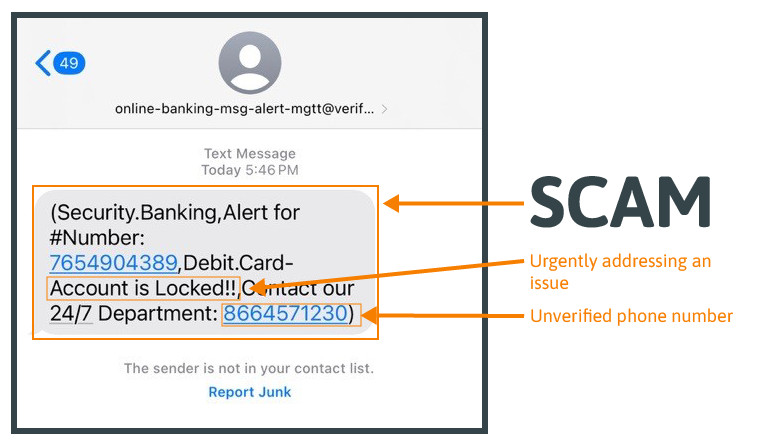

A call, text, or email arrives, seemingly from your credit union or another trusted source, urgently addressing an alleged issue. Often, they alert you of a debit card issue or ask you to verify a transaction you didn’t make. To make the call or text seem legitimate, they might even spoof the phone number to match that of a familiar company or institution. Once they have gained your trust, they may request sensitive information such as passwords, verification codes, PINs, or answers to security questions, claiming it’s necessary to resolve the supposed issue.

Alternatively, scammers may lead victims to click on links embedded with spyware, redirecting them to a fake website. Unaware, victims input their login details, falling prey to identity theft.

Guarding Against Impersonation Scams: Tips for Protection

Verify Before You Share

Scammers often target personal information, capitalizing on unexpected requests. Your first line of defense is to be vigilant. Take proactive steps to contact the company or organization you believe is contacting you. Instead of using the contact details provided in the suspicious message, reach out to the stated company directly using their official and verified contact information. This ensures that you are in direct communication with the legitimate entity, reducing the risk of falling victim to impersonation.

Unmasking the Tactics of Impersonation Scams

Be on the lookout for common red flags that may indicate a potential scam, such as immediate demands for personal information, requests for payment or financial transactions, or unusual communication methods. Additionally, be on the lookout for mismatched information; inconsistencies in communication could signal a potential scam, especially if they don’t align with your typical interactions. Trust your instincts and exercise caution when encountering suspicious messages or calls.

Exercise Caution: When in Doubt, Close it Out

When in doubt, don’t hesitate to hang up the phone, delete the message, or close the email. Remember, it’s okay to err on the side of caution. By simply disconnecting or removing yourself from the situation, you can prevent potential harm.

Pause, Reflect, and Take Action Wisely!

As your trusted financial partner, your security is our top priority at Park View Federal Credit Union. If you ever encounter suspicious activity or communication related to Park View Federal Credit Union, it is crucial to contact us directly at 540.434.6444. You can also visit a local branch for assistance. Our dedicated team is here to guide you and ensure the safety of your financial assets.

Remember, a real financial institution representative does not need access to your online banking to block fraudulent charges. If a caller begins asking you for personal information, or if you suspect you are talking to someone impersonating a financial institution representative, hang up immediately. Call back using a number from an official statement or website. While scammers can spoof phone numbers calling in, they can’t redirect your calls out, so calling a trusted number is the best way to protect yourself.

By being vigilant, verifying communication, and exercising caution, you can fortify your defenses against impersonation scams. For more information on when you receive unwanted calls, emails, and text messages that are probably scams, visit the FTC’s website.

Share This

You May Also Like

Understanding Trigger Leads and Protecting Your Privacy

Why You Need a Strong Security Question (and How to Set One Up)

Vacation Rental Scams: What to Watch For and How to Protect Yourself

Want to learn more?

Discover additional resources and other financial topics by visiting our Financial Education Center.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.