Hybrid Home Equity Line of Credit (HELOC)

Flexibility meets steady payments.

Why choose between the flexibility of a Home Equity Line of Credit (HELOC) and the predictability of a fixed-rate loan? With Park View’s Hybrid HELOC, you can enjoy the best of both worlds.

SPECIAL OFFER

Deferred closing costs1

Enjoy the benefit of deferred closing costs on your Hybrid HELOC, making it easier and more affordable to access the funds you need without extra upfront expenses.

Understanding a Hybrid HELOC

A Hybrid HELOC lets you borrow against the equity in your home like a regular line of credit, but also lets you lock in a fixed interest rate on part or all of the loan. This gives you flexible access to funds with the security of predictable payments.

Flexible Access:

Use your Hybrid HELOC whenever you need funds for any purpose.

Lock in Rates:

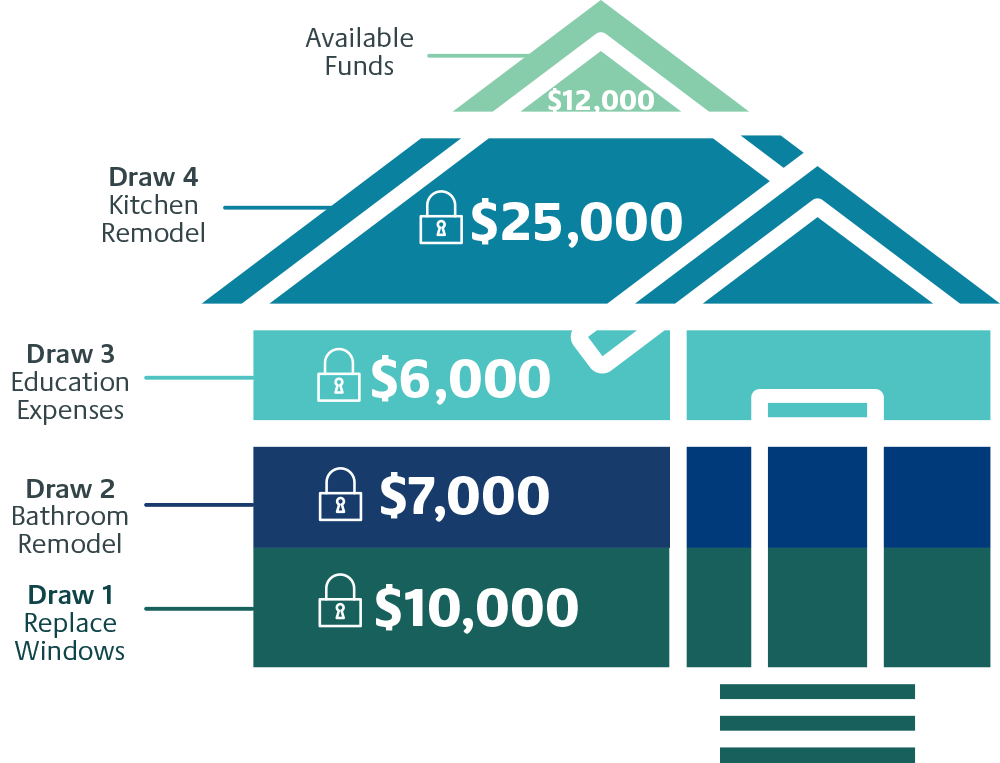

You can lock all or a portion of your Hybrid HELOC balance into a fixed-rate segment for a specified period of time during your draw period.2

Multiple Locks:

You can lock up to five segments at the same time.

Minimum Lock Amount:

Each fixed-rate segment must be at least $5,000.

EXAMPLE:

$60,000

TOTAL LIMIT

Hybrid HELOC Benefits

-

Flexibility

Choose how to structure your balance to fit your financial goals.

-

Multi-Purpose

-

No Prepayment Penalties

Pay down your balance faster if you’d like without any extra fees.

-

Steady Payments

-

Potential Tax Savings3

More Ways Park View Can Help With Your Financing

Park View offers our members a great range of products and services. Find out more about some of our other lending options:

Credit Cards

From cash back and reward points to travel perks and options to help you build credit, Park View Visa® Credit Cards are designed to fit your life.

Auto Loans

Whether you’re buying new or used, our Auto Loans offer competitive rates and flexible terms to make financing your next vehicle easy and convenient.

Personal Loans

Borrow to pay for whatever you want, whether it’s to cover the cost of an unforeseen expense, a big event, or to turn a dream into reality.