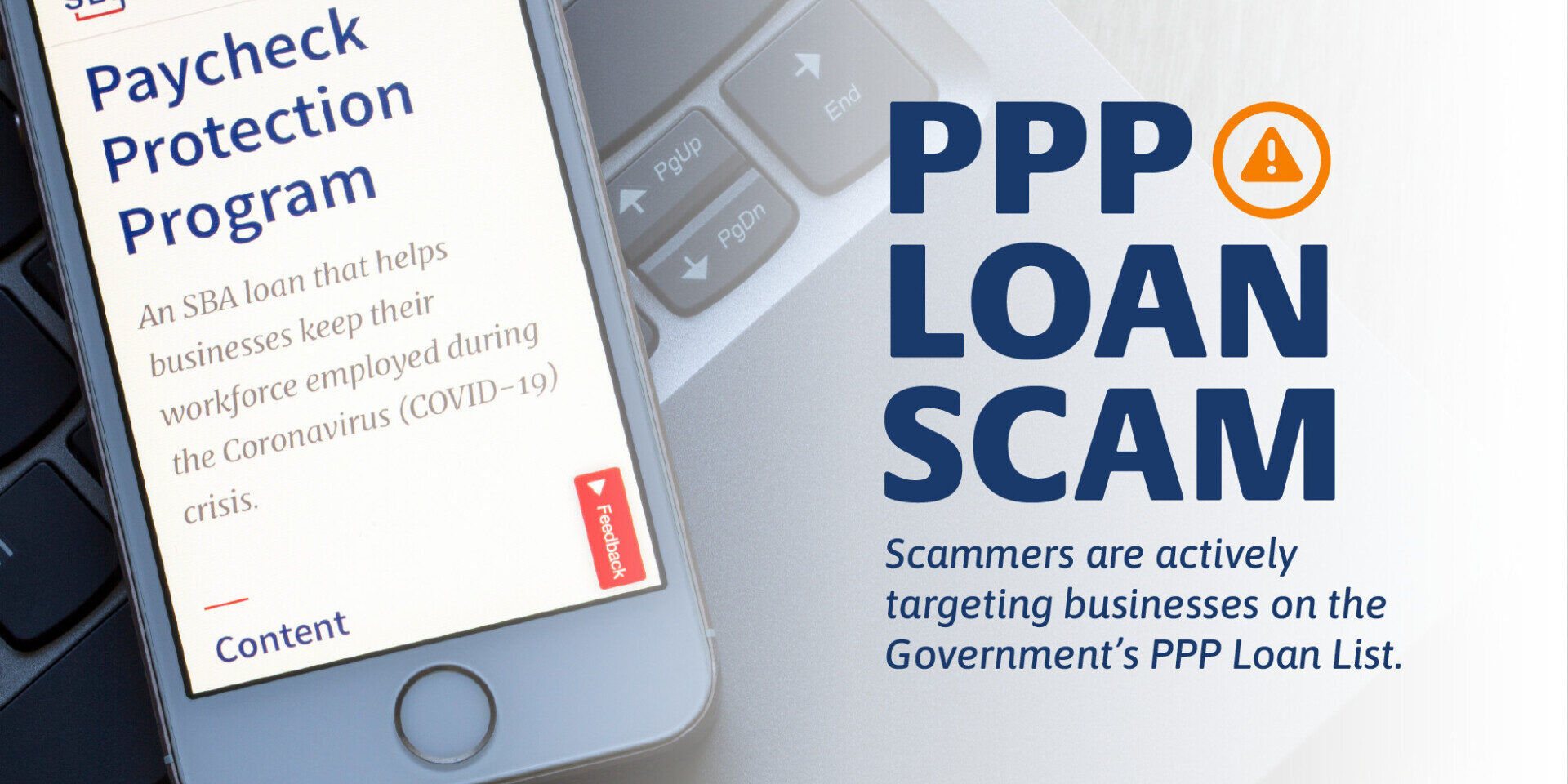

In the wake of the COVID-19 pandemic, the Paycheck Protection Program (PPP) became a lifeline for small businesses struggling to stay afloat. However, this much-needed help also opened the doors to opportunistic fraudsters and recently, there has been a surge in PPP loan scam attempts that continue to target unsuspecting business owners.

Exploiting PPP Loan Data

While scams related to PPP loans are not new, there has been an uptick in their prevalence. Fraudsters have capitalized on the loan data made public in December 2020 by the Small Business Administration (SBA), such as business names, types, addresses, loan amounts, funding dates, employee numbers, and financial institutions.

Their tactics are often convincing, utilizing scare tactics and sophisticated deceit to manipulate their victims.

Spotting the Signs of a Scam

To protect yourself and your business, it’s important to be able to recognize the warning signs of a PPP loan scam:

- Unexpected Contact: Be cautious of unsolicited calls or emails claiming missed court dates or urgent issues regarding your PPP loan.

- Threats of Legal Action: Any communication threatening jail time or legal repercussions for immediate payment should raise red flags.

- Requests for Immediate Payment: Demands for urgent wire transfers are a common tactic used by scammers.

- Impersonation: Scammers may claim to be law enforcement or government officials, but remember, authentic officials will not make such demands over a phone call or email.

Steps to Protect Yourself

Your vigilance is your greatest defense against PPP loan scams. Here’s what you can do to protect yourself and your business:

- Do Not Engage: If you receive a call asking you to wire funds under the threat of jail time, end the conversation immediately.

- Verify: Before taking any action, contact your loan officer directly using the contact information you have on file, not the details provided by the caller or email sender.

- Secure Your Information: Always keep your financial information secure and never share details with unverified sources.

- Report: Notify our Contact Center at 540.434.6444 about the attempted scam.

Stay Alert, Stay Safe

It’s crucial for everyone, particularly those who have utilized programs like PPP, to remain attentive against exploitation. By familiarizing yourself with the signs of a scam and knowing how to respond, you can protect your business, assets, and peace of mind.

Remember that while scammers may be cunning, they often leave behind clues of their deception. By knowing how to recognize these signs and understanding the correct measures to take, you’re arming yourself against becoming their next victim. Safeguard your business, your peace of mind, and your assets by staying informed and prepared.

For more insights and tips on scams and fraud impacting businesses, please visit the U.S. Small Business Association Website.

Share This

You May Also Like

Defending Against Impersonation Scams

How to Recognize and Protect Yourself from Scams

Want to learn more?

Discover additional resources and other financial topics by visiting our Financial Education Center.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.