Homeownership is more than just a personal milestone; it’s an investment in your future. And tapping into the equity of your home can be a savvy financial move when it comes to consolidating debt, making home improvements, or covering tuition fees. While conventional loan options like a Home Equity Line of Credit (HELOC) or a Home Equity Loan have been standard options, we’re excited to share that a new loan option has emerged: the Hybrid Home Equity Line of Credit (Hybrid HELOC) from Park View. In this article, we’ll explore how this innovative financial product can provide you with the convenience and control you need.

Understanding Home Equity

Simply put, home equity is the portion of your property that you truly “own.” It’s the current market value of your home minus any mortgage balance you still owe. If your home is worth more than what you owe on your mortgage(s), you have equity that could be tapped into through various loan products.

What is a Hybrid HELOC?

A Hybrid Home Equity Line of Credit combines the features of a traditional HELOC with the predictability of a Home Equity loan. Essentially, it’s a revolving line of credit that allows homeowners to borrow against the equity in their home, coupled with the capability of fixing the interest rate on all or portions of the loan.

With a typical HELOC, you can draw funds as needed, up to a certain limit, during the initial “draw” period. This is usually accompanied by variable interest rates that can fluctuate with market conditions. A Home Equity Loan, sometimes referred to as a second mortgage, offers a fixed interest rate and provides the funds upfront in a single lump sum. A Hybrid HELOC provides a middle-ground solution; it grants the flexibility of a line of credit with the option to lock in a fixed interest rate on various portions or all of the balance, preserving your financial comfort in an uncertain economy.

Why Choose a Hybrid HELOC?

Flexibility and Control

The primary attraction of a Hybrid HELOC is its dual nature. It empowers you with the ability to adapt your loan to match your financial situation. You can take advantage of dropping rates by keeping funds at a variable rate or secure a fixed rate when you feel rates will increase. This freedom allows you to manage your finances proactively.

Convenience for Ongoing Projects

For homeowners with long-term projects or phased home improvements, a Hybrid HELOC offers unrivaled convenience. You can fund your project’s stages without reapplying for additional loans and choose which portions to fix the interest rate on, giving you a predictable budget for your renovations. Plus, it offers a favorable interest rate compared to alternatives like personal loans or credit cards.

Protection Against Rising Interest Rates

While we can never fully predict how interest rates will move, a Hybrid HELOC shelters you from future hikes. By locking in rates on drawn funds, you ensure your rates remain unaffected by market spikes, offering you peace of mind amidst economic instability.

How Does a Hybrid HELOC Work?

A Hybrid HELOC operates under a simple mechanism:

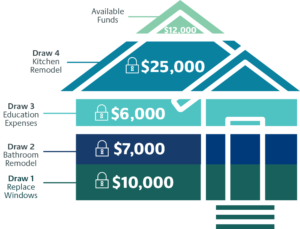

- Like a classic HELOC, you get approved for a maximum credit limit based on your home’s equity.

- You can access these funds, as needed, during a set draw period.

- For the money you use, you have the choice to keep it under a variable rate or lock it in at a fixed rate. With Park View’s Hybrid HELOC, you can have up to five fixed loan segments simultaneously, with a minimum segment lock of $5,000, maximizing your financial flexibility.1

- During the draw period, you make payments only on the money you’ve borrowed.

- After the draw period, you enter the repayment period where you pay back the full loan amount.

Is a Hybrid HELOC Right for You?

A Hybrid HELOC is ideal if you want to keep your borrowing options open without compromising on the predictability of your payments. Whether you are planning to refurbish your home or consolidate high-interest debt, this flexible financial tool could meet your needs while providing safeguarding measures against climbing interest rates.

Are you ready to harness the power of your home equity? Discover more about Park View’s Hybrid HELOC and other home equity loan options.

1Hybrid Home Equity Line of Credit (Hybrid HELOC) allows a member to create up to five (5) fixed loan segments with a minimum of at least $5,000 for each loan segment. Up to $100,000 can be in a fixed-rate segment. Fixed terms will be based on the existing rate of the HELOC. The fee structure remains the same as the regular HELOC initial loan application. There is a $25 fee to set up each segment. For qualified borrowers only. Contact Park View for full details. Park View is an Equal Housing Lender. NMLS# 653464

Share This

You May Also Like

Understanding Trigger Leads and Protecting Your Privacy

Strategies to Get the Lowest Mortgage Rate Every First-Time Home Buyer Should Know

The Ultimate Guide to FHA Mortgage Loans

Want to learn more?

Discover additional resources and other financial topics by visiting our Financial Education Center.