Enhancing your banking experience doesn’t have to be complicated; sometimes, it begins with a simple yet impactful change. Consider the shift from traditional paper statements to the modern convenience of eStatements. Upgrading to eStatements not saves you time and money, but it also bolsters your financial security by mitigating the risks associated with mail fraud and identity theft. In this blog, we’ll explore the 6 compelling reasons why making the switch to eStatements is a smart move for an elevated and more secure banking experience.

But, before we get started, let’s dive into what eStatements are.

Understanding eStatements:

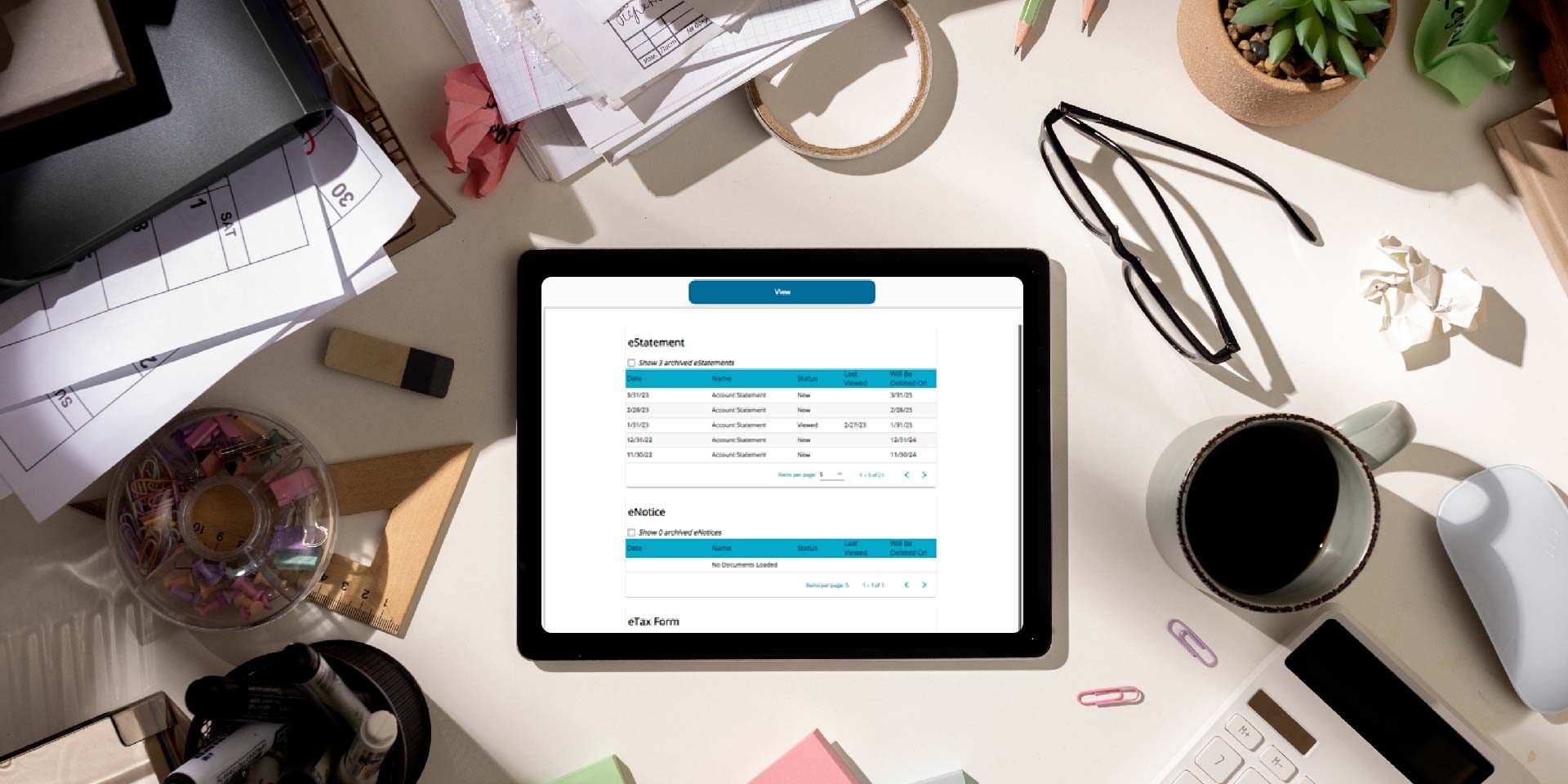

Electronic statements (eStatements) work similarly to paper statements, except for the fact that they’re delivered electronically. At the end of each statement period, you’ll get an email from Park View informing you that your eStatement is ready to view through online banking or the app. Once you access the eStatement, you’ll find it has all the information you’re used to getting with your paper statements. You can also access your eStatement by logging into your online banking site or app at any time throughout the month.

1. Check your accounts at a glance

With eStatements, there’s no need to wait for your monthly statement to arrive in the mail. With just a few clicks, you can check your account balance at any time, anywhere on your computer, tablet, or smartphone with up to 18 months of viewable statement history.

2. Clear out the clutter

Why bother with piles of paperwork when you can access your accounts digitally? It’s neater, cleaner, and helps cut down on stuff flooding your mailbox. You’ll also save time sorting through papers when you can find your last account cycle balance with just a few quick swipes. With eStatements, managing your accounts is easy.

3. Keep your information safer

No matter how careful you are with papers containing sensitive data, there’s always a chance you can miss something and it’ll end up in the wrong hands. However, you can access your account statements online with confidence, knowing that Park View Federal Credit Union uses several layers of protection to keep your information absolutely safe including two-factor authentication, digital encryption, and your unique login credentials to ensure the safety of your sensitive information. Keep your financial details secure with the convenience of eStatements.

4. Monitor your accounts for fraud

When you have instant access to your accounts throughout the month, it’s a lot easier to check for signs of fraud. Plus, when you spot the fraud sooner, you can take steps to stop and fix the damage earlier, giving you a better chance of a full recovery.

5. Eco-friendly

Less paper statements means less paper waste and fewer trees getting felled for something that will ultimately be tossed. Go green for the environment with eStatements!

6. Safe and secure storage

Filing cabinets are so last century. With eStatements, you’ll never stress about misplacing your account statements again. Your online banking portal or app acts as a convenient and secure filing cabinet, storing your account statements for access as needed.

Ready to make the switch to eStatements? Getting started is quick and easy.

Ensure you are enrolled in Online Banking before diving into eStatements. To sign up, simply log into your Online Banking or mobile account and navigate to the “Statements” section via the menu bar. Members can conveniently enroll using both the Mobile app and Desktop.

Here’s a quick guide:

- Log in to Online Banking or the Park View Mobile App

- Select “Statements” from the menu on the left.

- Choose “Manage Preferences“

- Review and Accept – it’s that simple!

Click here to learn more about eStatements with Park View Federal Credit Union. Making the switch has never been this simple!

Share This

You May Also Like

Defending Against Impersonation Scams

Tips to Prepare for Tax Season

Explore the Benefits of a Money Market Account

Want to learn more?

Discover additional resources and other financial topics by visiting our Financial Education Center.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.